Below are the reason to use banking system for those who are new to banks or who have no trust to use a bank at all.

Secure Money, Earn Interest and Get Loan.

Storing all your money in cash at home just isn’t safe .. Secure Money earn interest and get loan When you put money in Banks it becomes banks responsibility to secure your money.. Banks spends so much to provides security to your money.

Not only security but banks also gives interest amount on the amount on the amount deposited by as a customer. It makes our money grow monthly without any extra effort. Besides this, if we have a good credibility with our banks, we can get loan amount from banks in our financial emergency ..!

Inculcate habit of saving :-

Once we open account in bank, it because our habits to save the money. This is done when we go to bank and deposit our money..

Remittance using cheque demand draft :-

Apart from accepting deposits and lending money, banks also carry out, on behalf of their customers. the act of transfer of money – both domestic and foreign from one place to another . this activity is Known as “remittance business” Banks issue Demand Drafts , Banker’s cheque, money order for transferring the money. Banks issue Bank also have the facility of quick transfer of money also known as NEFT and RTGS. a demand draft or ” DD” is an instrument most banks in India use for effecting Transfer of money.. It is a Negotiable Instrument. To busy a “DD” from a Bank, you are required to fill an application form..

Avoid Risk of Chit funds:-

Avoid Risk of Chit Funds :-

India has nearly 10,000 registered chit funds companies. Chit funds, a saving avenue that is as popular with housewives as it is with businessmen, have earned a bad name. The reason in the scores of scams in the name of chit funds..

Banking Products

Whenever we go for opening an account in a bank, one thing comes to our mind – which type of account is best suited for us – an accounting , current account recurring deposit account or a fixed deposit account. banking products As a valued customer, bank offer innovative product to redefine banking convenience. with their expertise, we can rest assured that our wealth is protected and nurtured at the same time..

Types of Account and Deposits

Saving Account : A deposit saving account held at a bank or other financial institution that provides principal security and a modest interest rate . Depending on the specific type of saving account holder may not be able to write checks from the account (without incurring extra fees or expenses) and the account is likely to have a limited number of fee transfer / transactions. Savings account funds are considered one of the most liquid investment outside of demand accounts and cash. In contrast to savings account, checking account allow you to write check and use electronics debit to access your funds inside the accounts are generally for money that you don’t intend to use for daily expense. To open a savings account, simply go down to your local bank with proper identification and ask to open an account……………!

Current Account :-

A bank deposit account that support regular money transactions related to a business. This account is suitable for business purpose. the current account is an important indicator about an economy’s health. it is defined as the sum of the balance of the trade (goods and service), net income from abroad and net current transfer….

A Positive Current balance indicates that the nation is a net lender to the rest of the world while a negative current account balance indicates that it is a net borrow from the rest of the world. A current account surplus increases a nation’s net foreign assets by the amount of the surplus, and a current account deficit decreases it by that amount. The current account and the capital account are the two main components of a nation’s balance of payments..

Recurring Account:-

Recurring Deposit is a special kind of term Deposit offered by banks in India which help people with regular incomes to deposits a fixed amount every month into their Recurring Deposits account and earn interest at the rate application to Fixed Deposits.. It is similar t making FDs of a certain amount in monthly installment, for example Rs-1000 every month. This deposit matures on a specific date in the future along with all the deposits made every month. Thus, Recurring Deposits scheme allow customers with an opportunity to build up their saving through regular monthly deposits allow customers with an opportunity to build up their saving through regular monthly deposits allow customers with deposits of fixed sum over a fixed period of time. Minimum Period of RD is 6 months and maximum is 10 years..

Types of Loan and Overdrafts

Home Loans:– Home loans are taken by people for a variety of home-related purpose such as construction of home, home renovation, Home extension, Buying of property or land, or payment of stamp duties. home loans comprise an adjustment as adjustable or fixed interest rate and payment terms..!

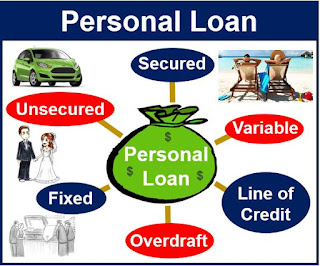

Personal Loans:- This type of loan is given to individuals after accessing their credential based on their professional or business, or any other source of income. The loan can be for any purpose for example, paying debt, marriage expense or vacation expenditure. NO collateral security is required for this type of loan….!

Education Loans:-

Required by and provided to student who want to pursue higher education in resident country or abroad. Student should have an admission offer an admission offer from an institution before they apply for an education loan. The loan takes care of the fees of the institution including examination and library fees; travel expenses for abroad; cost of books and equip me required ; any insurance for the student; if application…..!

Gold Loans :-

Gold loan is important only an providing gold as security to a bank or any other leading institution. it is considered as one of the safest methods as the loan amount is providing on the basis of the security submitted. Amount ranging from RS. 5k to 25lakh.. can be taken as loan against gold amount equivalent to 80 percent to 90 percent (varying from bank to bank) of the total value of the gold is given as loan to to borrower .. Depending upon the bank, the tenure of gold loan varies from one day to two years..

Vehicle Loans:-

Compared to other loans , it is easier and simpler to take vehicle loans. Vehicle Loans involve less paperwork and around three to six working days are required to get the clearance. the interest rates very from bank to bank based on their base rate. the repayment process involves monthly EMIs and repayment options…….!

Overdrafts:

An overdraft facility allows you to write cheques or withdraw cash from your current account less up to the overdraft limit approved. It is a short – tern (usually up to 12 months) standby credit facility which is usually renewable on a yearly basis. It is repayable on demand by the bank at any time. The overdraft limit is the maximum amount that you can overdraft. you pay interest only on the amount that you overdraft. Interest is calculated on the daily balance overdrawn and debited to the account monthly. any unpaid amounts of interest are added to the overdraft amount in the following month. the interest rate on an overdraft account is usually charged at a percentage over the bank’s prime lending rate, for example prime + 3% per annum……!

Thank you people for taking so much time for us

💔💔💔💔💔💔💔💔💔💔💔

And heartfelt thanks to you people who read our post………….💗💗💗💗💗💗💗